Hierarchical Risk Parity (HRP) for Crypto Portfolio Optimisation

Analysis of Hierarchical Risk Parity (HRP) for crypto portfolios. Comparing HRP variants vs Bitcoin holding over 3 years with surprising results on portfolio optimisation strategies.

Hierarchical Risk Parity (HRP) is a portfolio optimisation technique introduced by Marcos López de Prado in his paper "Building Diversified Portfolios that Outperform Out of Sample". HRP offers several advantages over traditional methods:

Advantages of HRP

- Non-parametric approach: Does not require estimating expected returns

- Robustness to estimation errors: Less sensitive to estimation error than Markowitz optimisation

- Dimensionality handling: Works well with high-dimensional, noisy data typical of crypto markets

- Cluster-based risk allocation: Effectively balances risk across different market segments

Why HRP for Cryptocurrency Markets

HRP is particularly well-suited for cryptocurrency portfolios because:

- Crypto markets exhibit high dimensionality and noise

- Return distributions are non-normal with extreme tail events

- Correlation structures change rapidly, requiring robust estimation methods

- Traditional mean-variance optimisation often fails due to instability

Project highlights

Hierarchical Risk Parity (HRP) & Variants

- Implemented classic HRP using a 60‑day look-back for covariance estimation and dynamic clustering.

- Explored two hybrid models — Momentum‑HRP and Momentum‑Weighted HRP — to see if momentum signals could enhance risk‐parity allocations.

Benchmark Strategie

- BTC Hold: 100% Bitcoin allocation as a simple buy‑and‑hold baseline.

- Equal Weight & Pure Momentum: To gauge the added value of risk‐parity and hybrids.

Backtest Framework & Visualisation

- Developed modular source code (

src/strategies,src/utils) with configurable parameters inconfig/strategy_params.yaml. - Automated runs (

run_all_strategies.py,compare_strategies.py) and produced clear charts: portfolio‐value trajectories, drawdown profiles, and Sharpe / Sortino metrics.

Key Findings

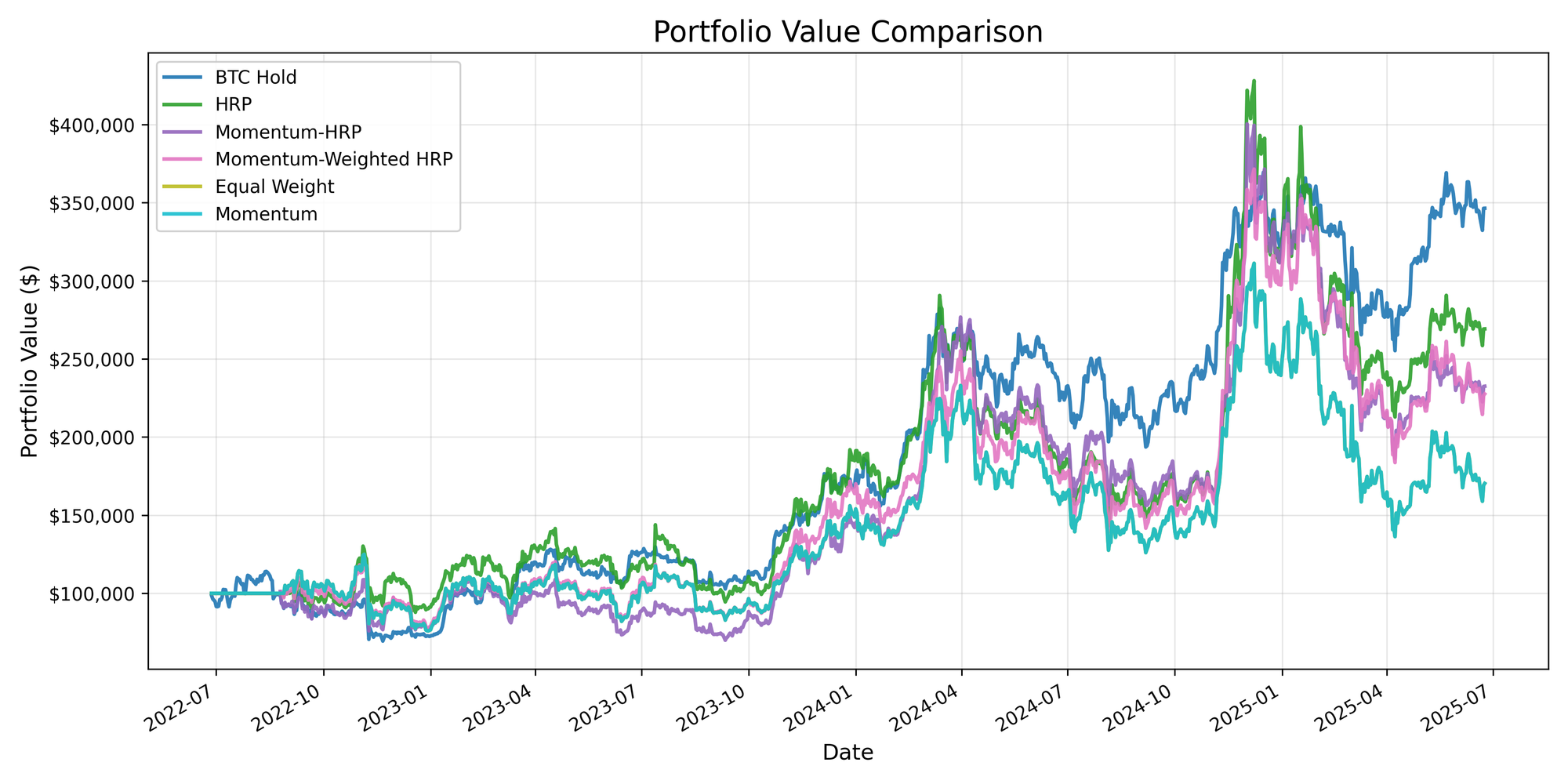

- Over June 2022 – June 2025, the simple BTC Hold outperformed all other strategies, delivering ~251% total return (52% annualised) with a max drawdown of ~39%.

- HRP variants delivered respectable returns but couldn’t consistently beat the Bitcoin‐only benchmark once transaction costs were considered.

- Hybrid models offered interesting diversification patterns but ultimately underscored how challenging it is to outperform a strong bull asset in its own market.

Performance Metrics Over 3 Years

| Strategy | Total Return | Annualized Return | Max Drawdown | Sharpe Ratio | Sortino Ratio |

|---|---|---|---|---|---|

| BTC Hold | 251.34% | 52.18% | 39.11% | 1.22 | 2.10 |

| HRP | 169.20% | 39.22% | 50.71% | 0.76 | 1.26 |

| Mom-HRP | 129.91% | 34.19% | 53.49% | 0.65 | 1.06 |

| Mom-W HRP | 127.55% | 31.62% | 50.55% | 0.61 | 0.97 |

| Equal W | 70.27% | 19.47% | 56.21% | 0.35 | 0.55 |

| Momentum | 70.27% | 19.47% | 56.21% | 0.35 | 0.55 |

Performance Considerations

- All reported returns are gross returns before transaction costs

- While HRP with daily rebalancing showed potential to outperform BTC in some market conditions, transaction costs (trading fees, slippage) completely eliminated this advantage

- Even without transaction costs, none of the tested strategies consistently outperformed a simple Bitcoin hold strategy over the full test period

Data Used

The analysis uses historical cryptocurrency price data spanning approximately three years (from June 2022 to June 2025). Key characteristics of the dataset include:

- Coverage: Approximately 40 cryptocurrency symbols, focusing on major cryptocurrencies and tokens with sufficient liquidity

- Frequency: Daily price data used for calculating weekly returns

- Point-in-time integrity: All strategies utilise only data available at the rebalance date (no look-ahead bias)

- Data ingestion via Binance and TradingView APIs into daily‐return CSVs

Top HRP Selected Assets

- Bitcoin (BTC): ~25-30% allocation

- Ethereum (ETH): ~15-20% allocation

- Other major assets: Varying allocations to assets like BNB, SOL, and XRP based on their risk characteristics

Lessons Learned & Next Steps

- Simplicity can be powerful: risk‐parity schemes sometimes can’t beat a single, high‐momentum asset in a bull market—highlighting the importance of regime‐aware models.

- Transaction costs matter: while HRP with daily rebalancing showed potential to outperform BTC in some market conditions, transaction costs (trading fees, slippage) completely eliminated this advantage.

- Data: the challenge is that crypto coins rotate by market cap very fast. It was not easy to decide on sample of coins and extract required data.

Read more: GitHub: crypto‑port‑opt

Get in touch:

- 📧 alexeyg377@gmail.com

- 🔗 LinkedIn Profile